At MD Realty, we encourage all inquiries and are committed to answering every question to the best of our ability. We believe that operating with integrity and transparency is fundamental to our business values. Please feel free to contact us at (210) 607-9779 at your convenience. There is never any obligation to proceed.

Below are a few of the more commonly asked questions from future investors.

What is a mortgage note?

A mortgage note, also known as a promissory note or mortgage promissory note, is a legal document that binds someone to repay their mortgage within an agreed upon period. The note outlines the terms of your lending agreement including the monthly payment, the interest to be paid, and what happens if the loan is not repaid.

Do I own the house?

No, if you are purchasing the note as an investment, you do not own the house. You are purchasing the mortgage note and the rights to collect the payments outlined in that note. The house is retained as collateral for the length of that note. If the payments were not made in accordance with the note, then you would have to right to foreclose on the property in order to collect on debt owed to you.

What is my return?

Returns can vary on each investment and every note is different but most of our investors receive over a 9% return.

Who collects the payments?

We set up all of our notes with a third party note servicer. The note servicer will collect the payment from the borrower, hold escrow for taxes and insurance, and send your principal and interest payment to you. This is set up at the beginning of the loan and is paid for by the borrower.

Do you use an RMLO?

Yes, we use an RMLO (Residential Mortgage Loan Originator) to create our mortgage notes. An RMLO must meet federal and state requirements to originate mortgage loans. They are licensed by the state and make sure loans are in compliance with state and federal guidelines.

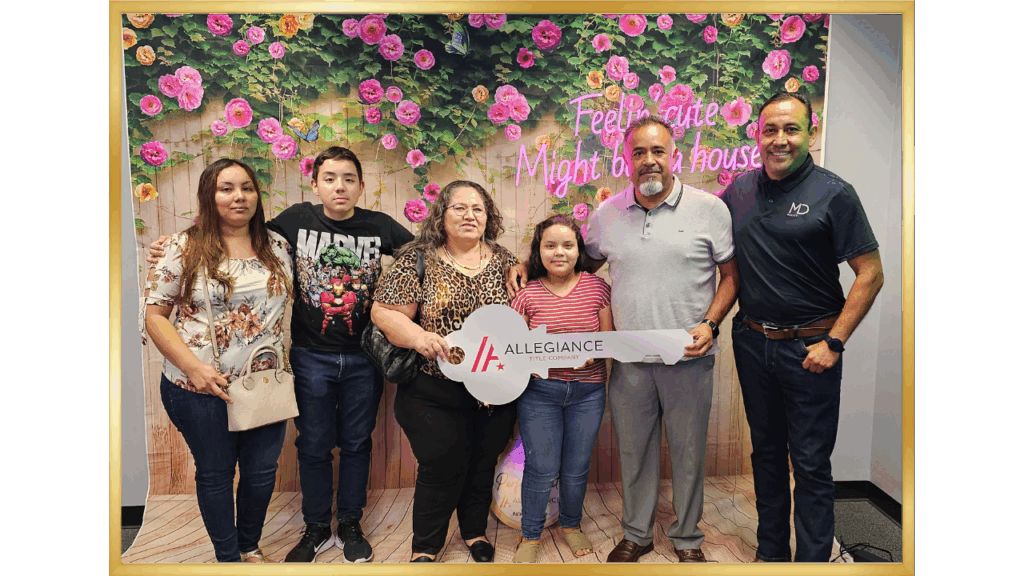

Who is your typical borrower?

The typical borrower is a local family with ties to the area. Many have little to no established credit (This does Not mean they have bad credit). Most are dual income families with little to no fied debt other than the home.

Can I invest through my IRA or 401K?

Yes, many of our investors use their IRAs or 401Ks to purchase investments from us. This does depend on which type of IRA or 401K you have but many will allow you to add real estate investments to your portfolio.

How active is this type of investing?

One of the nice things about this niche is how passive it can be. You are not managing contractors or rehabs. You are not dealing with tenants or toilets. Most of the time there isn’t much you need to do. You collect the cash flow and avoid a lot of the headaches of the other types of real estate investing.

What happens if the borrower stops paying?

If the borrower stops paying, you have some options. Some borrowers will sign a Deed in Lieu of foreclosure. This is basically them signing the house over to you. You can foreclose on the house. Texas is a non-judicial state and the foreclosure process is much faster than in many other states. Once you are the owner of the house you can sell the house, rent the house, or do anything you want with it. In the event that a borrower stops paying, we are happy to assist you in any way we can to help resolve the situation.

How much money do I need to start investing in notes?

There are different ways to invest in notes and the amount of capital you will need to start will depend on how you plan to invest in notes. Our typical note sells for approximately $150K. Most of our investors start with a minimum of $100K.

What exactly is note investing?

Note investing involves purchasing existing mortgage notes and becoming the lender. Instead of owning physical real estate, you are buying the debt (a “note”) secured by real estate. As the note holder, you receive monthly payments from the borrower, which include principal and interest. This strategy allows you to benefit from real estate without the hassles of property management. It’s a way to generate passive income, diversify your investment portfolio, and potentially earn higher returns than traditional real estate investments. Note investing can be done with both performing notes (where borrowers are making regular payments) and

non-performing notes (where borrowers have fallen behind on payments).

Is note investing riskier than traditional real estate investing?

All investments carry some level of risk, but note investing can actually be less risky than traditional real estate in many ways. When you invest in notes, you’re not responsible for property maintenance, tenant management, or unexpected repairs. The note is secured by the property, providing collateral. If the borrower defaults, you have options like loan modification or foreclosure to recover your investment.

How long does it typically take to see returns from note investing?

The timeline for returns in note investing can vary depending on your strategy. With performing notes, you can start receiving monthly cash flow immediately after purchasing the note. After you purchase a note, the very next payment is yours along with all future payments until the note is satisfied.

What are some of the pros and cons of investing in mortgage notes as opposed to traditional investments such as stock and bonds?

Here are some pros:

- Your investment is backed up by collateral (real estate).

- Greater predictability – Interest rates are set by the notes so you have fewer ups and downs as compared to the stock market.

- Diversification – Note investing allows you to reduce your reliance on traditional investments such as stocks and bonds. Mortgage notes can increase your diversification and possibly increase your overall portfolio performance.

What are some cons?

- Larger initial investment. Most of our mortgage notes are over $100K. This can prevent some people from investing in mortgage notes until they have the capital available.

- Less liquid than some other investments. Mortgage notes should be looked at as long-term investments. Mortgage notes are designed to be set up once and then performed for years to come.

Can I invest in notes if I don’t live in the United States?

Yes, you can invest in US-based notes even if you’re not a US resident. However, there are some additional considerations and potential challenges, such as setting up appropriate business entities and navigating tax implications. We recommend consulting with a US-based attorney and tax professional familiar with international real estate investments to help guide you.